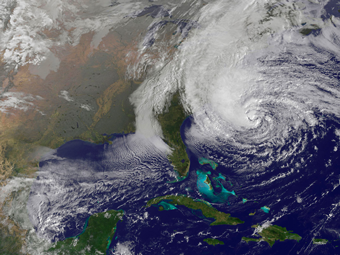

"Hurricane Sandy swept up the East Coast of the United States in late October 2012. The storm began in the southern Caribbean Sea and quickly developed first into a tropical storm, then into a hurricane. Hurricane Sandy made landfall in the United States the evening of October 29 near Atlantic City, New Jersey.

High winds and flooding caused dozens of deaths and massive damage to homes, businesses, power systems, transportation systems, and other property in many states, especially New Jersey and the New York metropolitan area. Sandy's reach placed it among the largest Atlantic tropical cyclones on record.

It will be months before the economic impact of Sandy can be fully assessed using data from the U.S. Bureau of Labor Statistics and other organizations. This Spotlight on Statistics provides a brief look at the pre-Sandy labor market in some of the areas of the United States hit hardest by the storm."

Twinsdad's comment:

This is hard data that provides details no other organization has. The Labor force Density alone tells the tale... I think all here should reflect a moment on what this means, for me, it makes 9/11 look like a small event...

"Hurricane Sandy struck at the most densely populated region of the United States. Four of the five counties with the highest number of labor force participants per square mile in 2011 were among those hardest hit by Sandy. All 26 of the counties designated as major disaster areas are among the top 10 percent of U.S. counties in terms of labor force density. The average density for these 26 counties, 1,301 labor force participants per square mile, was approximately 30 times the average density of the United States in 2011. The number of labor force participants in these 26 counties ranged from just under 27,000 in Bristol County, Rhode Island, to over 1.1 million in both Kings County (Brooklyn) and Queens County in New York. Their unemployment rates ranged from 6.5 percent in Rockland County, New York, to 12.9 percent in Atlantic County, New Jersey."

Twinsdad comment:

If you take the time follow the link you will learn that Sandy may be an event the country never recovers from...

http://www.youtube.com/watch?v=jdmZ-qIXS1Y

ReplyDeletehttp://www.youtube.com/watch?v=ba3VWbKbIEo

A couple of video's that give a sense of the damage to the Jersey coastline.

I have been in areas that currently have hundreds if not thousands of houses that may ultimately have to be abandoned and torn down.

Utilities alone will be slow to return. And when they return the houses themselves may not have adequate electrical connections to turn power back on due to sea water corrosion.

It's a mess. A major effort has to be made to cut through any red tape so some of the people impacted have a chance to return someday.

Private property owners, especially those relatively close to the ocean, should be carrying insurance for storm and flood damage. That should be a no-brainer, at least going forward. If we had a home in the area, and wanted to stay, we'd be rebuilding to a higher standard AND literally higher, as in, above the high water mark. I felt the same about NO and Katrina, but, surely enough, many homes and other buildings seem to have been rebuilt more or less in place.

ReplyDeleteWe were listening to a report yesterday about (NYC?) possibly issuing orders for condemned properties to be demolished and removed, but we weren't clear as to responsibility for those costs. Again, shouldn't property owners be responsible for carrying insurance for such events? Federal tax dollars that don't exist except in the minds of fools should not enter into the picture, except for road and public utility repairs.

Jean

I agree Jean. The federal program, like most federal programs, is a joke. People who want to live at or near sea level need to self insure. There is no private market for flood insurance.

Deletehttp://www.commondreams.org/headline/2012/11/13-10

Published on Tuesday, November 13, 2012 by Common Dreams

Federal Flood Insurance Program Running Out of Money

""It had become crystal clear, and it will probably become a little bit more clear, post-Sandy, that the premium structure was woefully inadequate," said Tom Santos, vice-president for federal affairs at the American Insurance Association.

The National Flood Insurance Program has already borrowed about $18 billion, largely to pay for damage from Hurricane Katrina, and can only borrow a total of $20.8 billion, according to the Wall Street Journal.

The program can only borrow $3.7 billion before asking Congress for more money.""

"The program insures 5.7 million homes near coasts or flood-prone rivers, the New York Times reports. Most homeowners insurance does not cover floods, and that insurance must be purchased through the federal program.

But Loretta Worters of the Insurance Information Institute told the New York Times that only 18 percent of Americans have flood insurance."

This comment has been removed by the author.

ReplyDeleteNJ Hurricane Sandy Raw Footage

ReplyDeletehttp://www.youtube.com/watch?v=lI0SdZ0a4UQ&feature=related